Description

Wyckoff Analytics – Point And Figure Part III

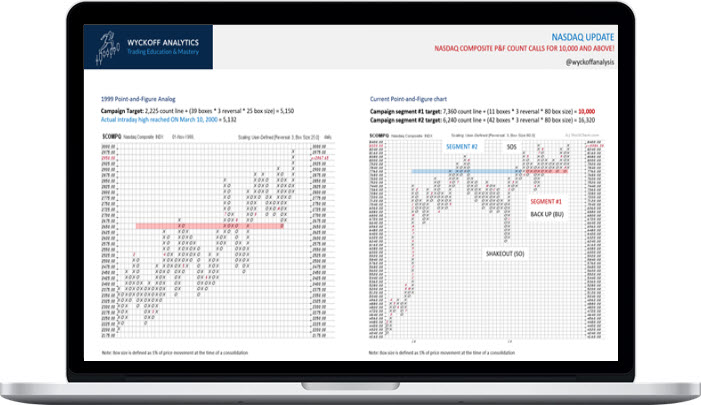

Wyckoff’s Law of Cause and Effect forms the foundation for his exceptional method of estimating price objectives using Point-and-Figure (P&F) charts. The underlying concept is deceptively simple, with the Cause equaling the horizontal P&F count in a trading range, which in turn generates an Effect or price target from the resulting trend. To obtain consistently reliable results with Wyckoff P&F charting, however, traders need a systematic approach, with guidelines that accommodate differences in trading range structures and timeframes.

We provided just such an approach, including some advanced and relatively new refinements, in our prior Point-and-Figure courses, which are among the most popular of all our on-demand courses. Point-and-Figure Part III, was developed in response to many student requests for additional applications of this remarkably versatile tool.

Point And Figure Part III course will include a review of some P&F fundamentals, followed by more advanced techniques.

What You’ll Learn In Point And Figure Part III?

Week #1: Point-and-Figure Foundations and More

During the first session, we will review and expand on the materials presented in our prior courses, including how to:

- Construct Wyckoff P&F charts using the StockCharts.com platform.

- Identify the correct count line in different trading range configurations (i.e., upsloping and down-sloping TRs as well as traditional horizontal consolidations).

- Apply refined horizontal P&F count guidelines to project price target zones, including how and when it’s appropriate to re-do counts and sequentially incorporate P&F phases.

- Determine when to use 1-box vs 3-box vs 5-box reversal techniques.

- Create and properly employ modified counts (using average true range and user-defined as well as traditional box sizes) and different scaling.

- Anticipate confirmation of projected price targets and resumption of a trend through stepping-stone counts.

- Take counts and project downside targets during distributional trading ranges, including critical differences in counting conventions and trading tactics in relation to accumulation.

- Contextualize Wyckoff’s Law of Cause and Effect to help you understand how and why this seemingly “magical” P&F technique produces such consistently accurate projections in any timeframe.

Week #2: Practical Applications in Multiple Timeframes

In the second session, we will apply the materials from Week #1 to illustrate:

- The usefulness of intraday P&F counts in short-term swing trading and in reliably anticipating near-term price movement on longer timeframes.

- Trading tactics throughout an entire trend based on long-term campaign counts.

- Refining timing and trade management from swing P&F (confirming) counts.

- Tape reading and trading off P&F charts – this is all-new content not available anywhere else, which should be particularly valuable for short-term traders.

Week #3: Advanced Point-and-Figure Techniques

In our Wyckoff Market Discussions, many students have asked about Bruce’s cutting-edge P&F analyses of individual securities and market breadth. In this session, we will present how to incorporate these methods into your trading. Specifically, we will demonstrate, step-by-step, how to:

- Utilize P&F as a convincer strategy in assessing a security’s relative strength in relation to any other market, including its peers, sector, industry group and the overall market.

- Apply and interpret percentage-scaled box sizes, which are particularly valuable in comparing multiple instruments.

- Evaluate the overall status of any market using Bruce’s adaptation of the Bullish Percentage, an indicator based on P&F charts of the components of any index.

More courses from the same author: Wyckoff Analytics